I had hoped to post a primer on recent surveys on the issue of Social Security earlier in the week, but my bout with a flu-bug got in the way. Fortunately, I discovered that the heavy lifting had already been done in a concise report by the Pew Research Center that conveniently summarizes virtually all of the recent polling on the issue. It is absolutely a must read for those who want a quick overall review.

I’ll say a bit more on the Pew report below, but first let me do a quick primer on their primer. One of the great challenges for all surveys on public policy issues is the danger of measuring what social scientists sometimes call “non-attitudes.” The idea, first hypothesized by the legendary political scientist Phil Converse in the 1960s, is that the social pressure to appear opinionated during an interview induces respondents to report opinions on topics about which they have little knowledge or have not formed prior opinions.

Many years of research and practical experience show that respondents in this situation do not generate attitudes at random, as Converse suggested, but rather draw cues from the language of the question and reason their way to an answer. The answers of respondents without prior opinions have meaning, but it is highly dependent on the wording of the question. Change that wording just slightly, and respondents may provide very different answers.

President Bush’s proposal for private Social Security Accounts provides a classic example. The Pew report tells us that many know little or nothing about it:

In Pew’s early January survey, only about a quarter of Americans (23%) said they heard a lot about the proposal; another 43% said they had heard a little, while 33% had heard nothing at all.

Yet while three quarters know little or nothing about the privatization proposals, Pew reports that only 3% to 16% offer a “don’t know” response when asked about them on various polls.

Of course, “non-attitude” may be a bit misleading in this case because the President’s proposals stir up a variety of more general attitudes that are very real and strongly held. Virtually every adult American comes into regular contact with the Social Security program, either as a payroll taxpayer or a beneficiary. Thus, the questions about private accounts may draw upon attitudes involving:

- The Social Security program generally

- The prospect of reducing Social Security benefits

- The likelihood of future generations receiving full benefits

- Taxes generally and Social Security payroll taxes in particular

- Investing generally and the stock market in particular

- President Bush

- Democrats in Congress

Now let’s consider those ideas in the context of the numbers in the Pew Center report. Social Security is certainly a popular program; 90% oppose “reducing Social Security benefits” (on a 1999 NPR/Kaiser/Harvard Study, though opposition is not quite as monolithic for less sweeping proposals to cut benefits).

At the same time, 55% to 60% question whether they will receive Social Security benefits when they retire. My hunch is that doubts about future benefits are driving the results in recent surveys (also cited in the Pew Report) that show 72-74% saying Social Security or has at least “major problems,” but only 18% to 24% agreeing that the program is “in crisis.

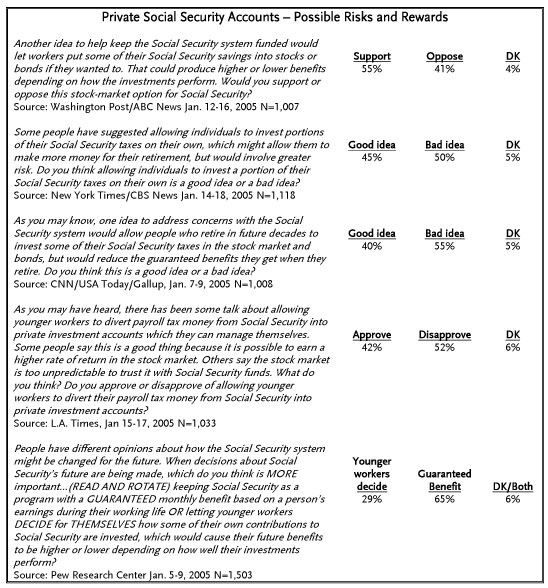

However, one of the most striking tables in the Pew Research Center Report, copied below, shows results from questions asked by five different organizations about private accounts during mid January that show support varying from 55% to 29%

“Yes Virginia,” as Ruy Teixeira put it in his summary of the report, “wording does matter” (and Ruy has been all over this topic lately). In general, on the questions the Pew Report, the more that the question language mentions increased risk, the role of stock market investments, the potential for reduced benefits, the lack of guaranteed benefits or describes the proposal as an initiative of President Bush, the less support it receives. Put another way, support for private accounts seems lower when respondents learn more about it.

It is hard to argue with the Pew Report’s conclusion that “public opinion on the various proposals being circulated is fluid and highly dependent on how the options are framed.” Expressed in the present tense, that is undeniable. However, as time passes and Americans learn more about Bush’s private account proposals, the results suggest that these currently fluid tenuous attitudes will solidify and move against Private Accounts in the same way public opinion moved against the Clinton Health Care proposals a dozen years ago.

More coverage of this topic, por favor.

This PROVES that Kerry won!

Your interpretation is one-sided. Of course, as people learn more about the potential RISKS of Bush’s proposal, their support will drop. But that is NOT the same thing as “learning more about Bush’s proposal”. As people learn more about the potential REWARDS (the fact that stocks always outperfom bonds over time horizons longer than 20 years), or more about the potential risks of the STATUS QUO (namely, precisely how actuarially unsound it is, because of earlier underestimations of lifespan of retirees and overestimations of fertility and the size of the future earning population), their support for Bush’s proposal would go up rather than down!

To say that the inevitable result of “learning more” will be an increase in opposition to Bush’s proposal reveals a partisan opinion that is out of place in a discussion of the effects of question wording (the effects of question wording on response will generally be agreed upon by pollsters of varying ideological stripes, the substantive value of Bush’s proposal won’t be).

Not relevant to polling, but to Social Security are comments made by FDR in 1935 on the future of Social Security:

http://www.pbs.org/wgbh/amex/presidents/32_f_roosevelt/psources/ps_socsecspeech.html

“In the important field of security for our old people, it seems necessary to adopt three principles: First, noncontributory old-age pensions for those who are now too old to build up their own insurance. It is, of course, clear that for perhaps 30 years to come funds will have to be provided by the States and the Federal Government to meet these pensions. Second, compulsory contributory annuities that in time will establish a self-supporting system for those now young and for future generations. Third, voluntary contributory annuities by which individual initiative can increase the annual amounts received in old age. It is proposed that the Federal Government assume one-half of the cost of the old-age pension plan, which ought ultimately to be supplanted by self-supporting annuity plans.”

Oh, but what did FDR know about social security anyhow? Sure sounds a lot like Bush’s plan to me…

I wouldn’t underestimate President Bush on this one.

Actually, it sounds like Clinton’s plan. At least according to Ron Brownstein of the LA Times. I don’t recall Clinton actually making a SS proposal. But I was only a kid then.

http://www.latimes.com/news/politics/la-na-outlook31jan31,0,2366341.column?coll=la-home-utilities

Bush’s plan has a “clawback” feature that can eat up most of the benefits of an “individual’s initiative.” In fact, if you’re “initiative” does not produce results greater than some assumed minimum return, you will end up behind. At least according to a Google search on “social security clawback”:

http://www.google.com/search?q=social+security+clawback&sourceid=mozilla-search&start=0&start=0&ie=utf-8&oe=utf-8&client=firefox-a&rls=org.mozilla:en-US:official

Just to be clear, the distinction FDR makes is between voluntary contributions and compulsory payroll taxes. Which is what we currently have with SS (compulsory) and voluntary IRA/403b/etc or what have you. And note that a person’s “initiative” should increase what a person receives, not supplant it. I think that is a big difference.

But then again, I’m one of those that feel the rewards of Bush’s plan can already be had via IRA’s/403b’s/etc. PLUS SS, the risks of the stock market are too great for the working poor, and the risks to social security are small enough that we can solve them within the current structure. But maybe that’s just me and a few others.

Keith Olbermann’s blog does a better job of dispelling the confusion that would lead one to believe that FDR argues for private accounts in the above quote.

http://msnbc.msn.com/id/6210240/

FDR doesn’t, and honestly philosophically he wouldn’t.

Bush’s plan does not save social security, it destroys it. After all the lies, why would anyone believe him. Social security can be fixed by raising the cap on taxable income, and rolling back tax cuts for the wealthy. People, don’t let him get away with this. Social security is all that some people live on. I am a living example.

Andrew Samwick’s plan for Social Security is cut cut cut while denying there are any cuts. Why just let the retirement age rise a few years here and a few years there, and with luck too few will survive to collect Social Security.